SF 1199A 2005 free printable template

Show details

+ Orientation Checklist ... Contact your NASA Ambassador and Supervisor prior to your first day to confirm your ... For a complete list of acceptable forms of ID, go to the following website, http://www.uscis.gov/files/form/i-9.pdf;

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign SF 1199A

Edit your SF 1199A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SF 1199A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SF 1199A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SF 1199A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SF 1199A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SF 1199A

How to fill out SF 1199A

01

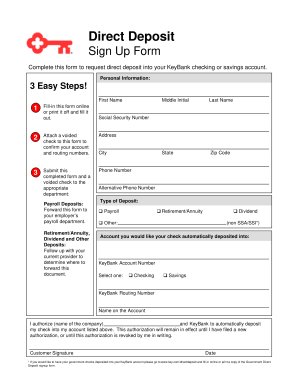

Obtain the SF 1199A form from the official government website or request it from your financial institution.

02

Fill out the top section with your personal information, including your name, address, and Social Security number.

03

Provide your account information, including the bank's name, routing number, and your account number.

04

Indicate the type of payment you are requesting (e.g., monthly benefits, annuity payments).

05

Sign and date the form to authorize the payment transfer.

06

Review the form for accuracy and ensure all required fields are completed.

07

Submit the completed form to your financial institution.

Who needs SF 1199A?

01

Individuals who receive federal benefits, such as Social Security, VA benefits, or retirement payments, need to fill out SF 1199A to authorize direct deposit to their bank account.

Fill

form

: Try Risk Free

People Also Ask about

How do I change my direct deposit information with Social Security online?

If you get Social Security benefits (retirement, survivors, or disability) or are enrolled in Medicare, you can change your address or direct deposit information online using the My Profile tab in your personal my Social Security account. You can also decide when the change will take effect.

How do I change my direct deposit location?

The process required to change direct deposit can be cumbersome. They would need to contact your HR department and fill out a form with the credentials of their new institution, authorizing the new bank to receive the direct deposit. This process can take two-to-four weeks, or one-to-two pay cycles.

How do I change my bank information for direct deposit?

The issue when you change direct deposit manually They would need to contact your HR department and fill out a form with the credentials of their new institution, authorizing the new bank to receive the direct deposit. This process can take two-to-four weeks, or one-to-two pay cycles.

How can I get my money back if I deposited into the wrong account?

Then you can personally visit the concerned bank and talk to the manager. You may have to produce all proofs and communications regarding the incorrect transaction. The bank manager will then contact the wrong recipient and request that the incorrect credit is re-transferred to you.

Can I change my bank account information?

Unfortunately, you can't change the account number for your bank, as that number tells payers and payees where to withdraw or deposit money in your name. But if your account has been compromised, you can open a new bank account.

How do I change where my Social Security direct deposit goes?

starting or changing Direct Deposit online (Social Security benefits only), or. contacting your bank, credit union or savings and loan association, or. calling Social Security toll-free at 1-800-772-1213 (TTY 1-800-325-0778), or. visiting your local Social Security Field Office.

How do I change my direct deposit for Social?

Use our automated phone assistance say "direct deposit." You will need to provide your current direct deposit routing number and account number to change your information over the phone. Call TTY +1 800-325-0778 if you're deaf or hard of hearing.

Can I change my direct deposit online?

If you need to make changes to your direct deposit information, you can do so either online or over the phone.

What is the form number for direct deposit?

To effect this change, the payee will complete a new SF 1199A at the newly selected financial institution. It is recommended that the payee maintain accounts at both financial institutions until the transition is complete, i.e. after the new financial institution receives the payee's Direct Deposit payment.

How do I change my Social Security automatic deposit?

starting or changing Direct Deposit online (Social Security benefits only), or. contacting your bank, credit union or savings and loan association, or. calling Social Security toll-free at 1-800-772-1213 (TTY 1-800-325-0778), or. visiting your local Social Security Field Office.

Can I do a direct deposit from one bank to another?

If you are wondering if you can set up direct deposit from one bank to another you'll be pleased to know consumers can use the same technology as these large institutions. You can set up direct deposit to handle bill payments and avoid using checks or receiving extra postage costs and hassle.

How do I change my direct deposit account number?

The easiest way to start or change direct deposit is to contact your employer's HR or payroll department, which will have you fill out a direct deposit authorization form. This form will ask for basic information that you can find in the welcome kit from your new bank: Name of bank or credit union. Routing number.

Can I change my direct deposit online with Social Security?

If you get Social Security benefits (retirement, survivors, or disability) or are enrolled in Medicare, you can change your address or direct deposit information online using the My Profile tab in your personal my Social Security account. You can also decide when the change will take effect.

Can I change my Social Security direct deposit to another bank?

Once you create your account, you can update your bank information without leaving the comfort of your home. Another way to change your direct deposit is by calling Social Security at 1-800-772-1213 (TTY 1-800-325-0778) to make the change over the phone.

What happens if I put the wrong bank but correct account number?

As noted above, your bank is identified by the routing number, so as long as your account and routing number are correct, you should not have a problem receiving your deposit. The IRS knows the name of the bank based on the routing number.

How long does it take Social Security to change direct deposit to another bank?

Once you sign up (regardless of the method), it takes 30 to 60 days for any direct deposit changes or new accounts to take effect. Make sure you don't close or switch your bank account before you see that first successful deposit.

What happens if you put the wrong bank info for direct deposit?

If you entered the wrong direct deposit account information, you have options to still get your refund: If you haven't filed yet, you can still change your bank account info for direct deposit. If the info you provided is for a closed or invalid account, the government will mail you a refund check.

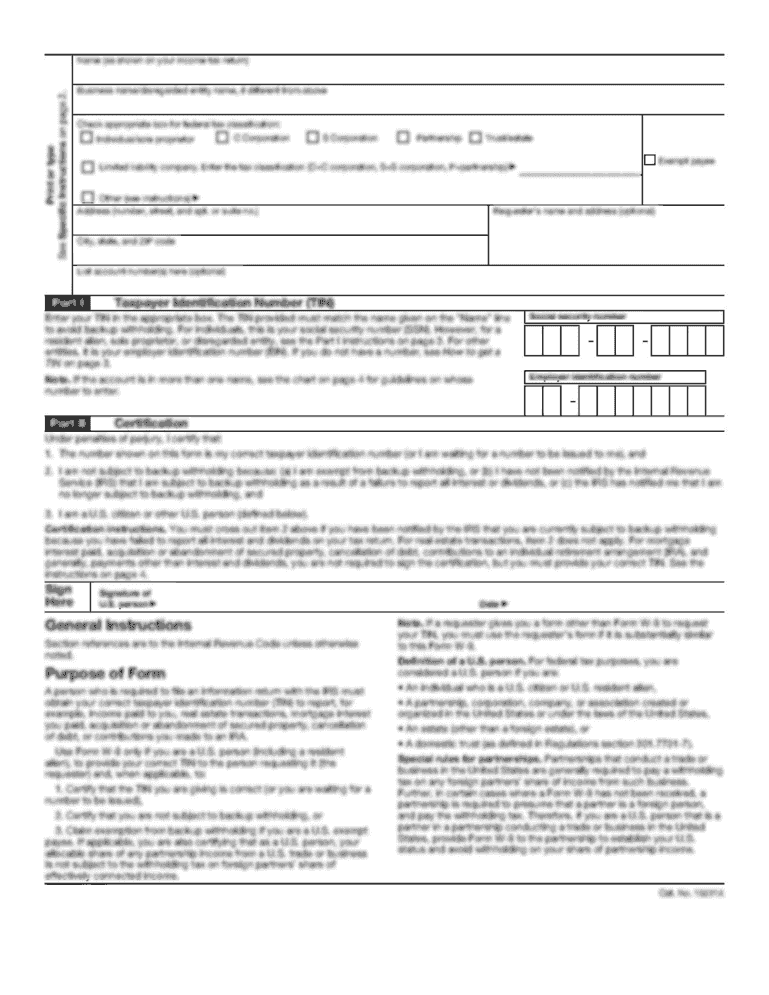

What is an 1199a direct deposit form?

What Is Form SF-1199a? Form SF-1199a is a direct deposit sign-up form for anyone who wishes to receive direct deposit payments from a government agency. This includes retirees receiving Social Security benefits, active military service members receiving salaries or veterans receiving pensions.

What is your claim or payroll ID number?

Claim or Payroll ID Number: The form cannot be processed without this information. Enter your Federal Employer Identification Number. This is your 9-digit tax ID number, issued by the IRS.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in SF 1199A?

The editing procedure is simple with pdfFiller. Open your SF 1199A in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the SF 1199A in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your SF 1199A and you'll be done in minutes.

How do I edit SF 1199A on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute SF 1199A from anywhere with an internet connection. Take use of the app's mobile capabilities.

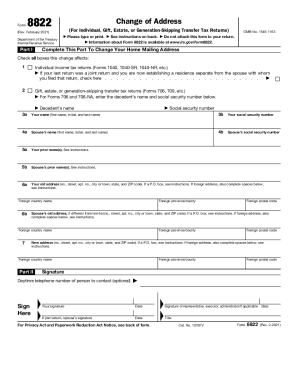

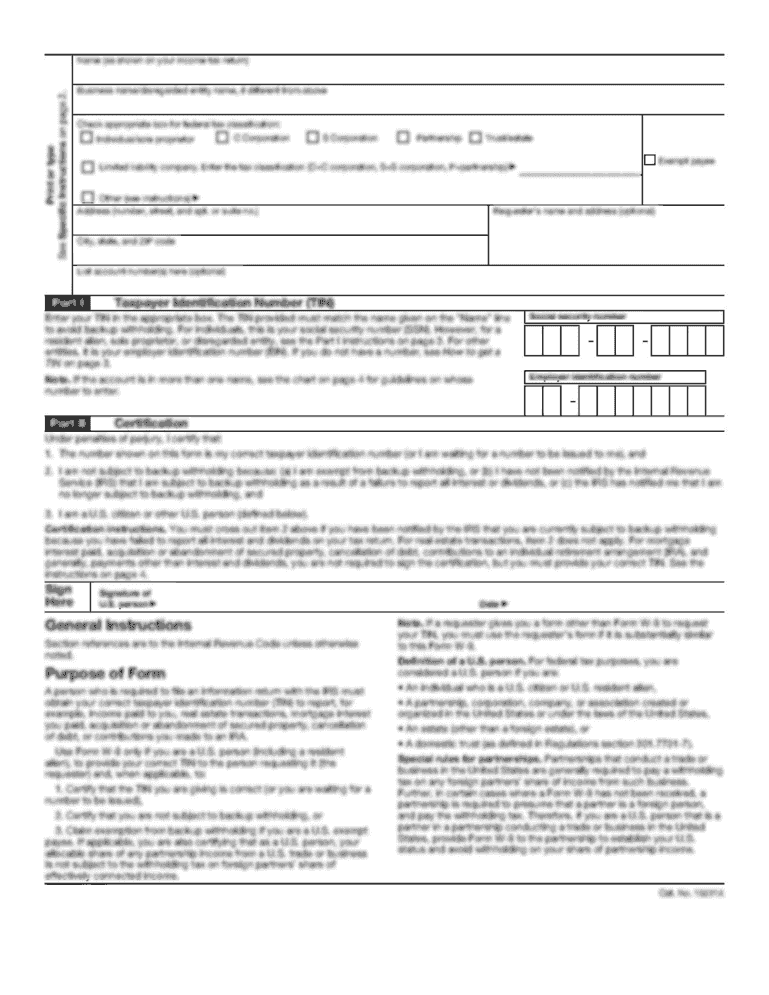

What is SF 1199A?

SF 1199A is a form used by the U.S. Department of the Treasury to authorize the payment of federal benefits via direct deposit. It serves as a request for financial institutions to deposit payments directly into an individual's bank account.

Who is required to file SF 1199A?

Individuals who receive federal payments, such as Social Security, veterans' benefits, or federal pensions, are required to file SF 1199A to set up direct deposit with their financial institution.

How to fill out SF 1199A?

To fill out SF 1199A, individuals must provide their personal information, including name, address, Social Security number, and account details of the financial institution where payments will be deposited. It also requires the signature of the individual and a witness, if necessary.

What is the purpose of SF 1199A?

The purpose of SF 1199A is to facilitate the direct deposit of federal payments into an individual's bank account, ensuring timely and secure delivery of funds while eliminating the need for paper checks.

What information must be reported on SF 1199A?

SF 1199A requires individuals to report their name, mailing address, Social Security number, type of account (checking or savings), account number, and the routing number of the financial institution.

Fill out your SF 1199A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SF 1199a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.